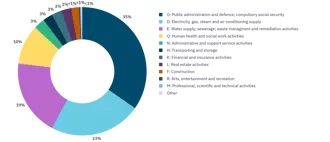

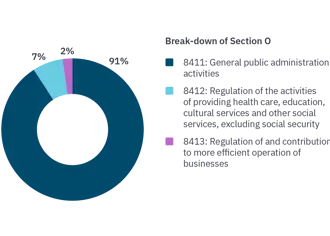

Public administration

Over 40 per cent of our loans and leases fall within section O: 'Public administration and defense; social security'. For us, loans in this section are predominantly (90 per cent) associated with investments in 'General public services' (NACE code 8411). Municipalities can take out loans based on annual capital expenditures, such as for example energy renovations and loan pools related to municipal agreements. The remaining part within this section, 8 per cent and 2 per cent respectively, goes to the sub-groups ‘Regulation of the activities of providing health care, education, cultural services and other social services, excluding social security’ (NACE code 8412) and ‘Regulation of and contribution to more efficient operation of businesses’ (NACE code 8413). The latter sub-group can include loans for the payment of the municipalities' share of, for example, the Copenhagen Metro. KommuneKredit does not provide loans for police or defense, as neither of these are municipal nor regional responsibilities.